“At the heart of systems thinking lie three deceptively simple concepts: stocks and flows, feedback loops, and delay. They sound straightforward enough, but the mind-boggling business begins when they start to interact. Out of their interplay emerge many of the surprising,” Kate Raworth, Doughnut Economics: Seven Ways to Think Like a 21st-Century

What is systems thinking?

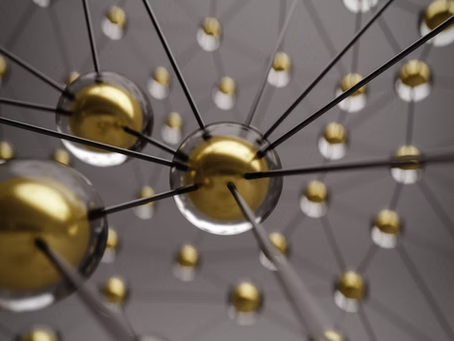

Systems thinking is a problem-solving approach that views issues as part of a broader, interconnected system rather than just focusing in on an isolated component of a problem. By understanding how each different element of a system communicate and influence one another, better positions firms to find sustainable, longer-term value and resilient solutions to highly complex problems.

Why finance needs more systems thinking

The financial sector is a classic example of an interconnected system built around short-term views and integrated with many other sectors, such as the real economy, politics, and wider society. Yet, when something needs to be fixed, there is a tendency to view the problem as linear and for it to be fixed as quickly as possible which forces siloed thinking, tackling the symptoms rather than curing the disease. While this may yield short-term benefits, it can result in unintended longer-term consequences that manifest in other areas—think of the 2008 financial crisis, where a narrow focus on high returns led to systemic failure.

If we were to take a step back and look at a problem again, this time looking at it as it would sit in an interconnected system and obtaining the views from a wider variety of stakeholders, there will be many cases where the problem is no longer linear and the time-frame of interest is longer and therefore a systems-thinking approach to addressing it is more effective.

The planet’s financial, economic, and ecological systems are intricate and deeply interconnected, and because of this, we need to adopt a holistic, systems-thinking approach, involving an understanding of the relationships and feedback loops within these systems. The assumption that the macroeconomic model will exponentially grow is based on the flawed assumption that our planet’s resources are infinite to support such growth. In short, the books don’t balance, and in a VUCA (volatile, uncertain, complex and ambiguous) world, traditional approaches to management and decision-making are falling short.

Systems thinking, scenario planning, and agile methodologies are among the strategies that leaders need to employ to navigate through VUCA environments effectively.

| Applying systems thinking to a Risk and Control Self-Assessment (RCSA) scenario Risk assessments in the area of Environmental, Social, and Governance (ESG) risks are too often conducted in silos, where each team assesses its own set of risks and maps their controls independent of one another. ESG risks, are inherently systemic and interconnected and demand a broader viewpoint. Interdepartmental Involvement – A systems-thinking approach to RCSA would involve a range of departments from the start. Alongside the core Risk, Strategy and Compliance teams, other units such as I.T./Cybersecurity, Investor Relations, Supply Chain/Procurement, and even External Affairs/Government Relations, for instance, enhances the breadth and depth of the assessment. By drawing a wide representation of departments, the RCSA becomes more holistic, capturing an array of interconnected risks and insights. Broad Risk Landscape – Diverse teams bring to the table their own expertise and perspectives. For instance: |

| I.T./Cybersecurity could highlight vulnerabilities in digital infrastructure and potential technological disruptions including cyber threats. Enterprise Risk Management (ERM) provide a view of enterprise-wide risks. Investor Relations can shed light on investor trends and demands. Government Relations can dig deeper on the broader political and societal environment. Compliance could weigh in on conduct, culture and reputational risks. |

| By considering wider viewpoints, the firm gets a bigger picture view of the complex landscape of ESG risks. Iterative Dialogue – In a systems approach, there is a continuous, iterative dialogue between departments. For example: a regulatory alteration detected by Compliance could necessitate the Operational Risk (OR) team to revisit certain controls. A subsequent lapse in an OR control could then prompt a secondary line review, prompting an assessment of the broader implications. Such findings could then guide the ERM team to recalibrate the overarching risk frameworks. This continuous feedback loop ensures the RCSA remains dynamic, relevant, and insightful. Stakeholder Perspectives – Mapping of stakeholders will enable firms to incorporate a variety of stakeholder viewpoints. Looking beyond internal departments can wield significant insights that can influence a firm’s risk profile. The Investor Relations team, for instance, can provide investor trend insights ensuring client views, societal impacts, trends and long-term sustainability is considered. This might even include obtaining insights from the next generation of clients. Dynamic Adjustments – Given the unpredictable nature of the current environment, RCSAs need to be dynamic and allow for a continual feedback loop for adjustments to risk management strategies, investment choices, and customer engagement. By implementing a systems-thinking approach to the RCSA, financial firms can move beyond the limitations of traditional, isolated risk assessments. They can create a more robust, resilient, flexible, and comprehensive ESG risk management strategy that is not only aligned with current short-term needs but is also adaptable to future longer-term challenges and opportunities. |

Conclusion

As the financial landscape becomes increasingly complex and interconnected, there’s a growing need for approaches that can navigate this complexity effectively and sustainably. Systems thinking offers a lens through which we can better understand the intricate web of interdependencies that define our financial system. By adopting a systems-thinking approach, we can move towards solutions that are not just effective in the short term but are also resilient and sustainable in the long term.

Should you require expert assistance or access to a trove of helpful resources, you can read more blogs here.